Payroll services to power your business

Grow your business with payroll services, expertise and unified technology.

The benefits of ADP payroll services

Payroll is our expertise, and our certified payroll professionals are on hand to advise and offer support. We offer regional and local payroll outsourcing expertise. Our experts understand the requirements and implement payroll amid constantly changing regulations.

ADP payroll services help you to:

Overcome the complexity and risk of sourcing, managing and delivering payroll services.

Unify and standardise your payroll processes into a best-in-class model that helps reduce HR administrative costs.

Anticipate changes in laws and regulations, while managing differences in time zones, currency and language.

Benefit from a single view of workforce data for reporting and analytics, improving fact-based decisions.

Payroll services that scale as you grow

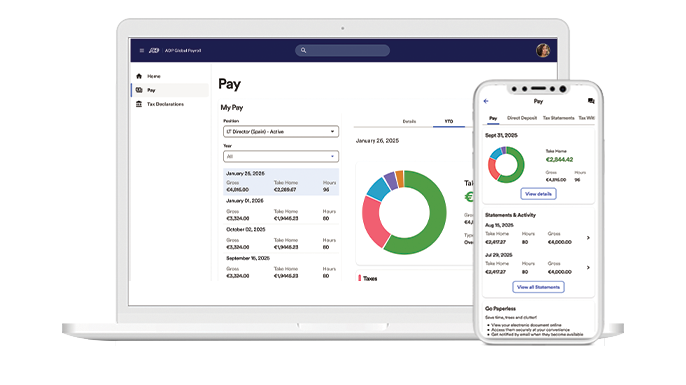

ADP provides flexible payroll solutions that help to simplify payroll, so you can scale up or down depending on your business needs. We manage the complexities and day-to-day tasks of payroll, so you can focus on running your business. By ensuring greater accuracy and seamless integration, our cloud-based payroll software also delivers insights to help you make more informed decisions.

Our extensive network of experts enables us to provide both local or global coverage, depending on where your business is based. So you can now meet all payroll expectations effortlessly. As a payroll services provider, we offer:

- Payroll processing that’s faster and easier — locally and globally

- Online employee and manager self-service

- Certified, experienced payroll professionals

- Simple integration with your existing business software, time tracking, HR systems and enterprise resource planning (ERP)

Payroll services built for your organisation’s size

ADP offers payroll outsourcing services and unified technology to companies of all sizes. We can flex our payroll services according to your budget, business size, and specific needs.

Payroll for 1–199 employees

Get payroll done in just a few clicks. We help you to stay compliant at all times, with taxes done for you, and software that integrates with your accounting, POS or time systems.

- Payroll processing in easy steps

- Taxes calculated and paid on your behalf

- Local compliance support

Payroll for 200 –1,000+ employees

Keep your employees engaged and productive by integrating payroll with HR, via flexible and custom-configured payroll solutions.

- Fully automated employee data management

- Integration with HR, time & attendance, and more

- Scalable levels of service and outsourcing

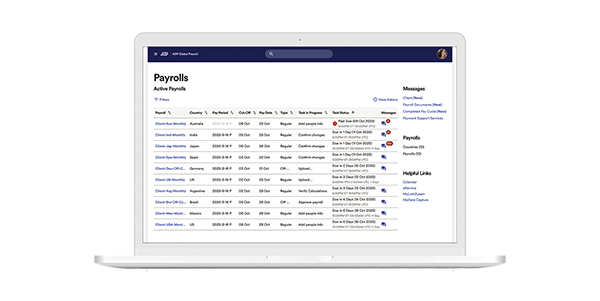

Payroll for employees around the globe

Gain clarity with one solution to unify multi-country payroll processing. Our customer service team covers 45 languages, providing support from 13 global service centres.

- Simplified global payroll

- Unified global reporting

- Compliance management

How ADP payroll solutions work

ADP payroll services are comprehensive, offering partially or fully managed payroll outsourcing with varying levels of service to best meet your needs. From processing payslips, to issuing Form 16 and helping you keep compliant with local regulations, ADP payroll services simplify the administrative tasks of managing payroll.

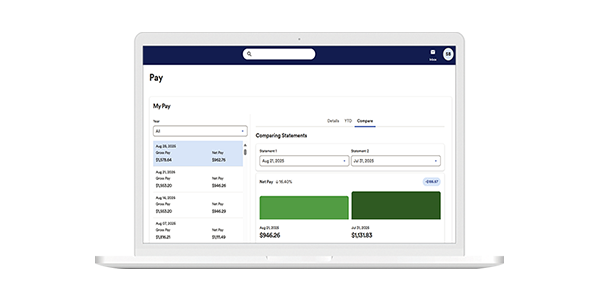

Our platform lets you access a wide range of workforce-related reporting services, delivering reports from headcount to labour cost analysis, across geographies and employee populations. These are flexible enough to integrate easily with third-party HCM systems.

Award winning Global Payroll from ADP

Discover ADP global payroll services

Who we work with

Join the growing community of businesses leveraging ADP’s powerful technology, expertise and insights.

Why our clients choose ADP for payroll services

Only 26% of businesses rate the performance of their current payroll provider as good or very good, according to the 2019 EY Global Payroll Survey. Yet, when you work with the right payroll service provider, you can relax knowing that you’ve lowered your risk - your employees will be paid accurately and tax liabilities met on time. Our payroll software ensures your business remains compliant to the ever-changing legislations in India and global markets, helping you avoid fines and penalties.

ADP offers more options than any other payroll services provider. We’ve been living and breathing payroll for 70 years, and more than 1,000,000 customers globally trust us to deliver and support modernised payroll processes. With 45 support centres in 140 countries, we’re here with you on your journey to unlock the power of payroll.

Get startedAwards and recognition

Your ADP payroll services FAQs answered

- What is payroll and how does it work?

-

Payroll can be anything from paying your employees and calculating taxes and deductions, to filing necessary taxes and ensuring compliance obligations are met. Payroll can either be carried out in-house or entrusted to a reputable provider like ADP. If you decide to outsource your payroll, you can opt for partially or fully managed models, depending on your business size and how much control you want to keep.

- What do payroll services do?

-

Payroll providers carry out a range of services for companies who don’t wish to run an in-house payroll. These include calculating employees’ pay, making any necessary deductions such as EPF contributions and third payments.

- What are payroll managed services?

-

If you choose as a business to hand over every payroll process to a trusted outsourced provider like ADP, this is known as payroll managed services. This option ensures your HR, finance and admin teams are freed up from time-consuming work and helps you to deliver accurate, timely and compliant payroll.

- Who needs payroll services?

-

Is your business struggling with running in-house payroll? Can’t afford the time or expense to recruit, train and retain accounting or HR professionals? You could benefit from outsourced payroll services. You’ll save the costs of an in-house department, and avoid the complexity of reporting to government authorities. Plus, say goodbye to manual errors and potential fines for missing compliance deadlines.

- Why ask ADP to process payroll for me?

-

Having ADP to manage your payroll runs gives you more time to focus on higher-value tasks, including business strategy, hiring and retaining the right people, and driving employee development and engagement. Not only will managed payroll save you time, it will give you peace of mind in this increasingly complex world. In addition, we take your data protection extremely seriously, which is why we add an extra level of governance to your employee data.

- What are the different payroll services provided by ADP?

-

ADP offers a range of payroll and HR products and services and services, including a processing service with a hosted platform; or a managed service offering online payroll services, solutions and software for businesses of all sizes. Our cloud payroll solutions can integrate with time and attendance tracking. Plus, we also automatically calculate deductions for taxes and EPF contributions, providing expert support to help make sure you stay compliant with all applicable rules and regulations.

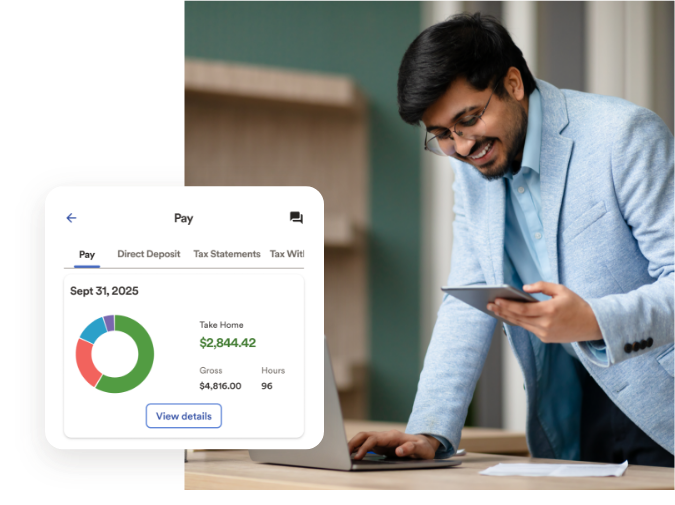

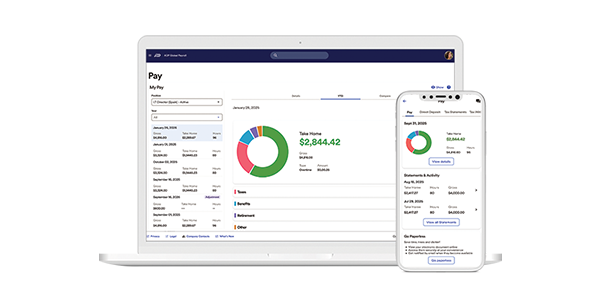

- Does ADP have online payroll tools or a mobile platform for employees?

-

ADP Employee Self-Service portal gives employees access to their payroll information and benefits, no matter where they are. Employees can complete a variety of tasks, such as view their payslips and manage their leaves.

Let's find the perfect solution for your business

Fill out the form and see what the ADP team of payroll and HR experts can do for you.

Latest articles & insights

guidebook

What to expect from payroll in 2024

guidebook

Could inefficient payroll processes hinder your company’s growth plans?

insight